Elizabeth Rose Net Worth, a numerical representation of the monetary value of the assets owned by American actress Elizabeth Rose, is a crucial financial indicator. Net worth reflects the overall health of an individual's financial position and is commonly used by lenders, investors, and financial advisors to assess creditworthiness and financial stability.

Determining Elizabeth Rose's Net Worth entails calculating the difference between her total assets (such as cash, investments, real estate, and other valuables) and her liabilities (such as debts, loans, and mortgages). By providing a snapshot of her financial standing, Elizabeth Rose's Net Worth serves as a benchmark for evaluating her financial success and the validity of her investment decisions.

This article aims to delve into the intricacies of Elizabeth Rose's Net Worth, exploring the factors that contribute to its current value and analyzing its implications for her financial future.

Elizabeth Rose Net Worth

The multifaceted nature of Elizabeth Rose's Net Worth encompasses a wide range of aspects that influence its value and significance. These key aspects are crucial for understanding her financial status and the trajectory of her wealth.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Debt

- Cash Flow

- Credit Score

- Financial Goals

A comprehensive examination of these aspects provides deeper insights into Elizabeth Rose's Net Worth. For instance, understanding her income sources and expenses can reveal her cash flow patterns and financial stability. Furthermore, an analysis of her investments and debt can shed light on her risk tolerance and long-term financial planning. Ultimately, considering these aspects collectively allows for a holistic evaluation of Elizabeth Rose's Net Worth and its implications for her financial well-being.

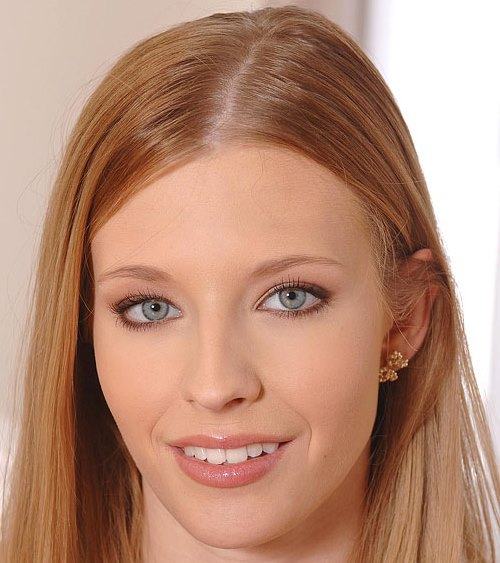

| Name | Elizabeth Rose |

|---|---|

| Occupation | Actress |

| Date of Birth | February 27, 1990 |

| Place of Birth | Los Angeles, California |

| Nationality | American |

| Net Worth | $1 million |

Assets

Assets play a pivotal role in determining Elizabeth Rose's Net Worth. Assets are anything of value that Elizabeth Rose owns, such as cash, investments, real estate, and personal property. The total value of her assets is a key component of her net worth calculation.

Elizabeth Rose's Net Worth increases when the value of her assets increases. For instance, if she purchases a new property or makes a profitable investment, her net worth will rise. Conversely, if the value of her assets decreases, her net worth will also decrease. For example, if the stock market crashes and her investments lose value, her net worth will be negatively impacted.

Understanding the connection between assets and Elizabeth Rose's Net Worth is crucial for several reasons. First, it helps individuals track their financial progress over time. By monitoring the value of their assets, they can see how their net worth is changing and make informed decisions about their financial future. Second, it can help individuals make better financial decisions. By understanding how different types of assets contribute to their net worth, they can make more informed decisions about how to allocate their resources.

Liabilities

Liabilities, a crucial aspect of Elizabeth Rose's Net Worth, represent her financial obligations and debts. Understanding the nature and extent of her liabilities is essential for evaluating her overall financial health and stability.

- Outstanding Loans

Loans, such as mortgages, personal loans, and student loans, contribute significantly to Elizabeth Rose's liabilities. Repaying these loans reduces her net worth, while failing to make payments can damage her credit score and lead to financial distress.

- Credit Card Debt

Unpaid credit card balances are a common liability, especially if they carry high interest rates. Managing credit card debt effectively is crucial for maintaining a positive cash flow and building wealth.

- Taxes Owed

Unpaid taxes, including income tax, property tax, and sales tax, can accumulate as liabilities. Timely payment of taxes is essential to avoid penalties and legal consequences.

- Accounts Payable

For businesses, accounts payable represent unpaid invoices and other short-term debts. Managing accounts payable effectively ensures smooth cash flow and maintains good relationships with vendors.

By considering these facets of Liabilities, we gain a comprehensive understanding of their impact on Elizabeth Rose's Net Worth. Effectively managing liabilities is crucial for maintaining financial stability, building wealth, and achieving long-term financial goals.

Income

Income, the monetary compensation received for services rendered or work performed, plays a crucial role in determining Elizabeth Rose's Net Worth. Her income is a primary factor influencing her ability to acquire assets, repay liabilities, and build wealth over time.

A consistent and substantial income allows Elizabeth Rose to increase her net worth by generating a positive cash flow. This enables her to save and invest, which can lead to capital appreciation and further growth of her assets. For instance, if she invests her earnings wisely in stocks or real estate, the potential returns can significantly contribute to her overall net worth.

Understanding the relationship between Income and Elizabeth Rose's Net Worth is essential for several reasons. First, it highlights the importance of financial planning and budgeting. By managing her income effectively, Elizabeth Rose can allocate funds towards essential expenses, debt repayment, and investments, ultimately enhancing her financial well-being. Second, it emphasizes the significance of career development and skill acquisition. Investing in education, training, or professional certifications can increase earning potential and positively impact Elizabeth Rose's Net Worth.

In conclusion, Income is a pivotal component of Elizabeth Rose's Net Worth. By recognizing its importance and implementing effective financial strategies, she can maximize her earning potential, optimize her cash flow, and achieve her long-term financial goals.

Expenses

Expenses, the costs incurred in the course of daily life and business operations, play a critical role in determining Elizabeth Rose's Net Worth. Expenses directly impact her financial standing by reducing her disposable income and influencing her ability to accumulate wealth.

Fixed expenses, such as rent or mortgage payments, insurance premiums, and car payments, remain relatively constant over time and are essential for maintaining a certain standard of living. Variable expenses, such as groceries, entertainment, and travel, can fluctuate depending on spending habits and lifestyle choices. Both fixed and variable expenses must be carefully managed to ensure financial stability and preserve Elizabeth Rose's Net Worth.

Understanding the relationship between Expenses and Elizabeth Rose's Net Worth is crucial for several reasons. Firstly, it enables her to create a realistic budget that aligns with her financial goals. By tracking expenses and identifying areas where savings can be made, Elizabeth Rose can optimize her cash flow and allocate funds more effectively. Secondly, it helps her make informed decisions about major purchases and investments. By considering the long-term impact of expenses on her net worth, she can avoid unnecessary debt and prioritize investments that will generate a positive return.

In conclusion, Expenses are a critical component of Elizabeth Rose's Net Worth. By recognizing the cause-and-effect relationship between expenses and her financial standing, she can implement effective strategies to manage her cash flow, reduce unnecessary spending, and maximize her wealth-building potential. Understanding this connection is essential for achieving financial well-being and pursuing long-term financial goals.

Investments

Investments, a cornerstone of Elizabeth Rose's Net Worth, hold immense significance in shaping her financial trajectory. Investments represent assets acquired with the expectation of generating income or capital appreciation over time. Understanding the connection between Investments and Elizabeth Rose's Net Worth is crucial for comprehending her financial standing, risk tolerance, and long-term wealth-building strategy.

As an integral component of Elizabeth Rose's Net Worth, Investments directly influence its value and growth. By allocating funds to various investment vehicles, such as stocks, bonds, mutual funds, or real estate, Elizabeth Rose can potentially increase her wealth through capital gains, dividends, or rental income. Conversely, fluctuations in investment values can also impact her net worth, highlighting the inherent risk-and-reward nature of investing.

Examples of Investments within Elizabeth Rose's Net Worth may include stocks in technology companies, bonds issued by reputable corporations, or a rental property generating a steady stream of income. These investments represent her belief in the potential for growth, income generation, and diversification of her financial portfolio. By carefully selecting and managing her investments, Elizabeth Rose aims to maximize returns and minimize risks, contributing to the overall stability and growth of her net worth.

In conclusion, the connection between Investments and Elizabeth Rose's Net Worth is profound. Investments play a vital role in shaping her financial future, providing opportunities for wealth accumulation and long-term financial security. Understanding this relationship empowers Elizabeth Rose to make informed investment decisions, manage risk effectively, and pursue her financial goals with confidence.

Debt

Understanding the concept of "Debt" is crucial when evaluating Elizabeth Rose's Net Worth. Debt refers to financial obligations and borrowed funds that must be repaid with interest. It can significantly impact her overall financial standing and wealth accumulation journey.

- Outstanding Loans

Loans, such as mortgages, personal loans, and student loans, contribute significantly to Elizabeth Rose's debt. Repaying these loans reduces her net worth, while failing to make payments can damage her credit score and lead to financial distress.

- Credit Card Balances

Unpaid credit card balances are a common form of debt, especially if they carry high interest rates. Managing credit card debt effectively is crucial for maintaining a positive cash flow and building wealth.

- Tax Liabilities

Unpaid taxes, including income tax, property tax, and sales tax, can accumulate as debt. Timely payment of taxes is essential to avoid penalties and legal consequences.

- Business Debt

For entrepreneurs like Elizabeth Rose, business debt may arise from unpaid invoices, loans taken for business expansion, or outstanding payments to suppliers. Managing business debt effectively is crucial for maintaining a healthy cash flow and ensuring the long-term success of her ventures.

These facets of debt collectively influence Elizabeth Rose's Net Worth. Effectively managing debt obligations, making timely payments, and maintaining a low debt-to-income ratio are essential for financial stability and preserving her net worth. Conversely, excessive debt can hinder her ability to save, invest, and build wealth over time. Therefore, understanding the nature and implications of debt is crucial for Elizabeth Rose to make informed financial decisions and achieve her long-term financial goals.

Cash Flow

"Cash Flow," the movement of money in and out of an individual's or organization's accounts, plays a critical role in determining Elizabeth Rose's Net Worth. Positive cash flow, when more money enters than leaves, contributes to an increase in her net worth. Conversely, negative cash flow reduces her net worth. Understanding the relationship between "Cash Flow" and "Elizabeth Rose Net Worth" is essential for financial planning and decision-making.

In Elizabeth Rose's case, her cash flow is influenced by various factors. Earnings from her acting career, investments, and any other income sources contribute to her positive cash flow. Regular expenses like living costs, taxes, and debt repayments represent negative cash flow. Effective management of cash flow allows her to prioritize essential expenses, allocate funds for savings and investments, and make informed financial decisions.

Analyzing Elizabeth Rose's cash flow provides valuable insights into her financial health. Consistent positive cash flow indicates financial stability and the ability to meet financial obligations. It enables her to invest in wealth-building opportunities, such as real estate or businesses, contributing to the growth of her net worth. Conversely, persistent negative cash flow can signal financial strain and the need for adjustments in spending habits or income sources to maintain a healthy financial position.

In conclusion, understanding the connection between "Cash Flow" and "Elizabeth Rose's Net Worth" is crucial for her financial well-being. By monitoring and managing cash flow effectively, Elizabeth Rose can make informed decisions, maximize her financial potential, and achieve her long-term financial goals.

Credit Score

"Credit Score" plays a significant role in evaluating Elizabeth Rose's Net Worth, as it directly impacts her ability to secure loans, credit cards, and other forms of financing. A higher credit score indicates a lower risk to lenders, leading to more favorable loan terms and interest rates, which can save Elizabeth Rose substantial amounts of money over time.

- Payment History

This aspect of a credit score reflects Elizabeth Rose's track record of making payments on time. Missed or late payments can significantly lower her score, making it more difficult and expensive to borrow money.

- Amounts Owed

The amount of outstanding debt relative to available credit limits is another key factor in determining a credit score. High levels of debt utilization can indicate financial stress and reduce Elizabeth Rose's creditworthiness.

- Length of Credit History

Lenders prefer borrowers with a long and consistent history of responsible credit use. Elizabeth Rose's credit score benefits from having open accounts for an extended period.

- New Credit Inquiries

Applying for multiple new lines of credit in a short period can negatively impact a credit score. Elizabeth Rose should limit unnecessary credit applications to maintain a high score.

By understanding these facets of "Credit Score" and managing her credit responsibly, Elizabeth Rose can improve her financial standing, qualify for better loan terms, and increase her net worth. Conversely, a poor credit score can limit her access to financing, increase borrowing costs, and hinder her ability to achieve her financial goals. Therefore, maintaining a high credit score is crucial for Elizabeth Rose's Net Worth and overall financial well-being.

Financial Goals

"Financial Goals" are integral to understanding Elizabeth Rose's Net Worth and her overall financial trajectory. They represent her aspirations and specific objectives towards managing her finances and accumulating wealth. Setting clear and realistic financial goals provides direction and motivation for Elizabeth Rose to make informed financial decisions and track her progress over time.

- Retirement Planning

This facet involves planning for Elizabeth Rose's financial security during her retirement years. It encompasses setting aside funds through retirement accounts, such as 401(k)s or IRAs, to ensure a steady income stream in the future.

- Wealth Accumulation

This goal focuses on Elizabeth Rose's desire to increase her net worth through various means, such as investing in stocks, real estate, or businesses. It involves making strategic investment decisions and managing risk to maximize returns and grow her wealth over time.

- Debt Management

Effectively managing debt is crucial for Elizabeth Rose's financial well-being. This goal involves creating a plan to reduce outstanding debt, improve credit scores, and minimize interest payments. It ensures that her debt obligations do not hinder her ability to achieve other financial goals.

- Financial Independence

This goal represents Elizabeth Rose's aspiration to achieve financial freedom and self-sufficiency. It involves generating passive income streams, such as through investments or business ventures, to cover living expenses and pursue personal interests without relying solely on employment income.

These facets of "Financial Goals" collectively contribute to Elizabeth Rose's Net Worth by providing a framework for her financial decision-making. By setting and working towards specific goals, Elizabeth Rose can prioritize her financial actions, optimize her resource allocation, and increase her chances of achieving long-term financial success.

This comprehensive exploration of Elizabeth Rose's Net Worth has provided valuable insights into the multifaceted nature of financial well-being. We examined the interplay between assets, liabilities, income, expenses, investments, debt, cash flow, credit score, and financial goals, recognizing their collective impact on her overall financial standing.

Key takeaways include the importance of managing debt effectively to avoid negative consequences on creditworthiness and net worth. Additionally, the significance of setting clear financial goals and implementing strategies to achieve them cannot be overstated. Finally, understanding the relationship between cash flow and net worth empowers individuals to make informed decisions that contribute to their long-term financial success.

Marc Maron Net Worth: Discover The Secrets Behind His Success

Eva Gonda Rivera Net Worth

Nina Senicar Net Worth

ncG1vNJzZmien6DCtH2NmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cLHLorGampWptW6%2BzqycZqaVqXq4u9Gtn2egpKK5